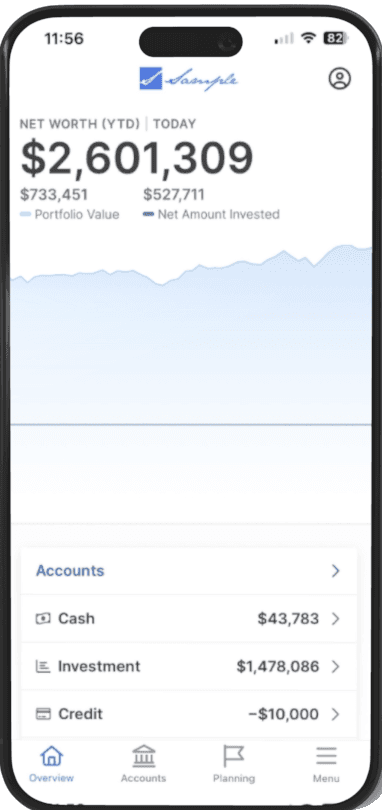

One Platform. All Your Wealth

Our platform works the way you do, efficient, integrated, and totally on your terms. With WealthShed you gain access to…

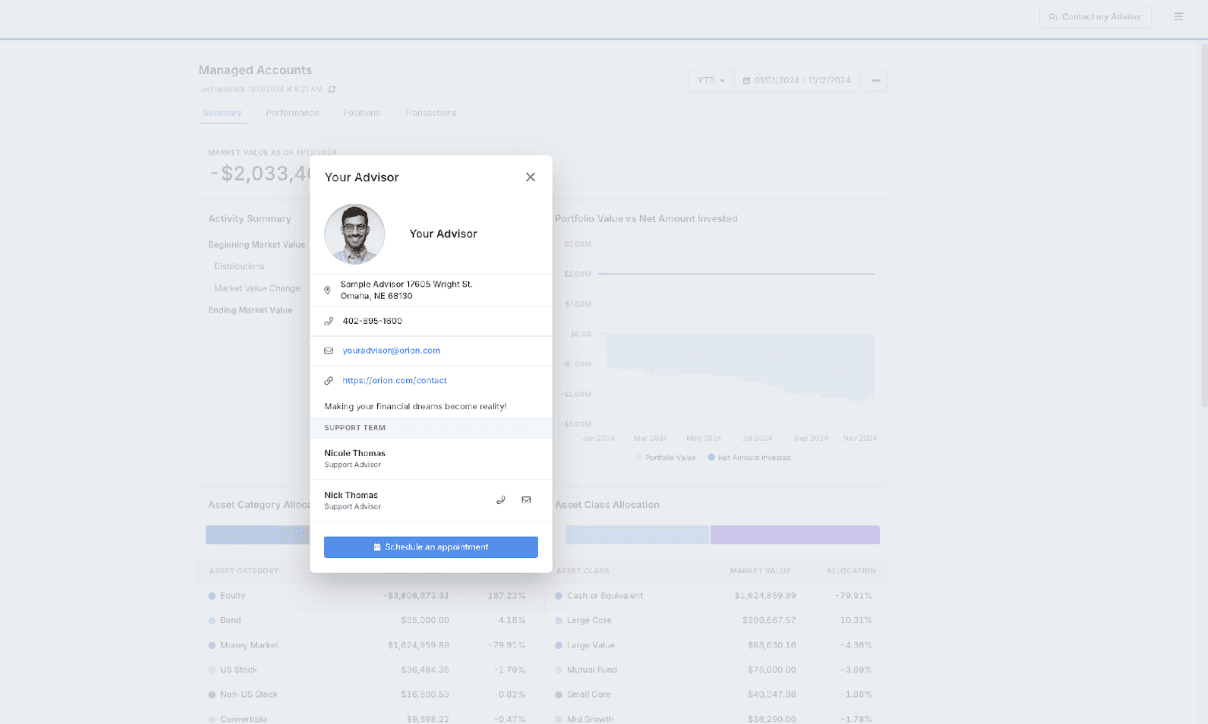

Human Experience Meets Smart Tech

We believe the best planning comes from the synergy between technology and real human advice. Combining our advisors years of experience, with tech-based delivery allows for more transparency, support, and discussion as your plans evolve.

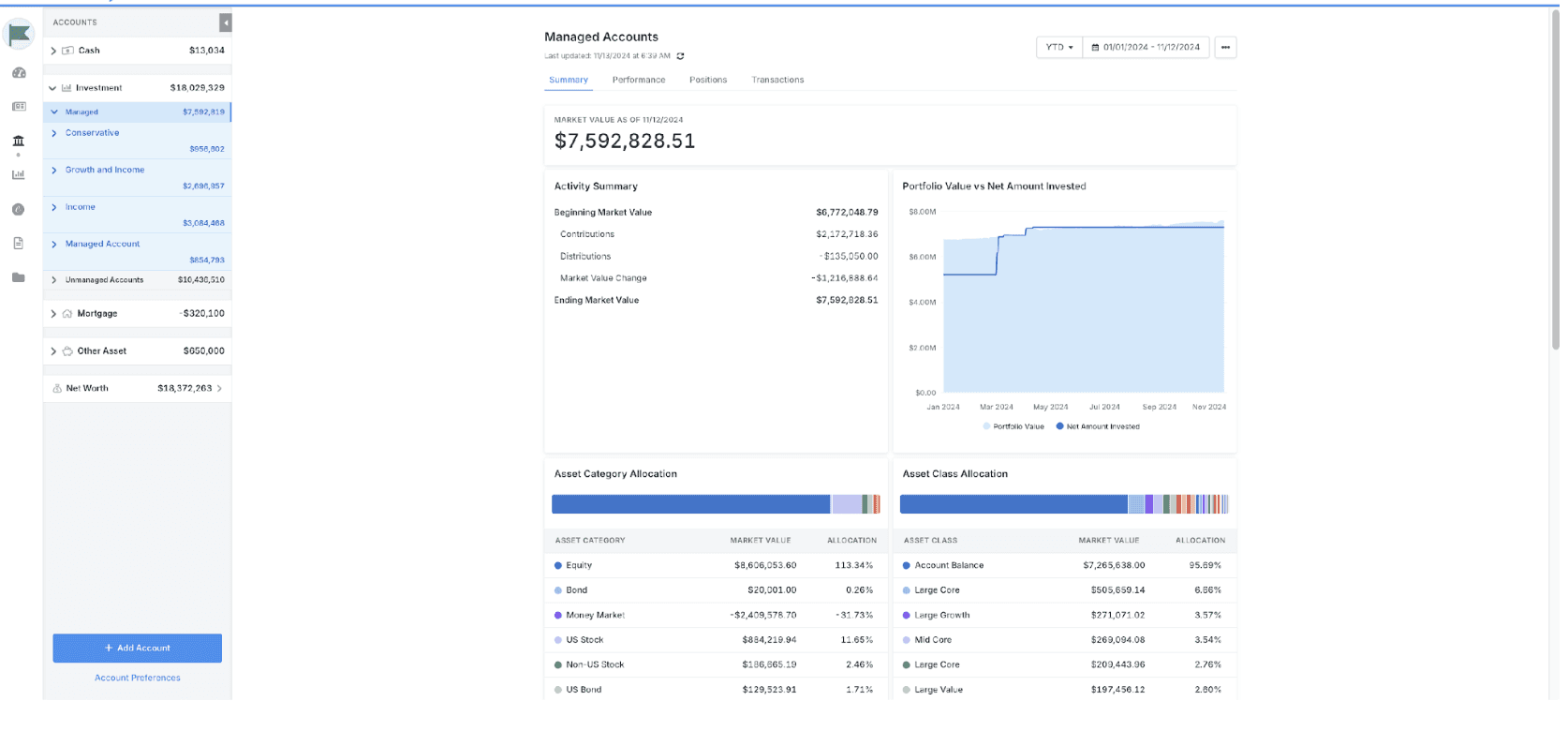

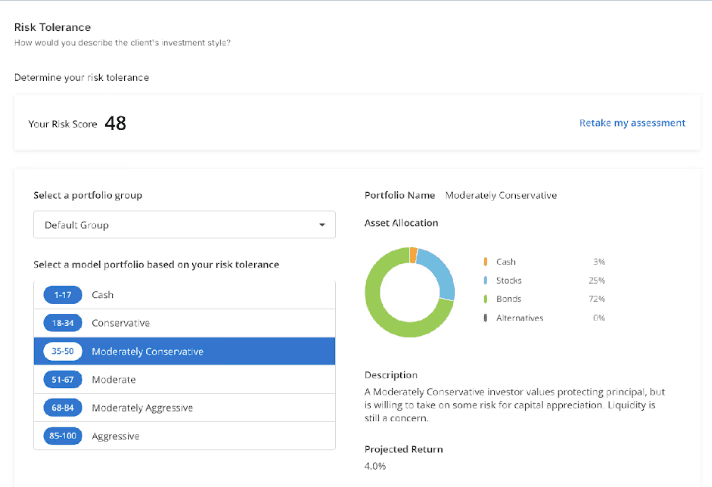

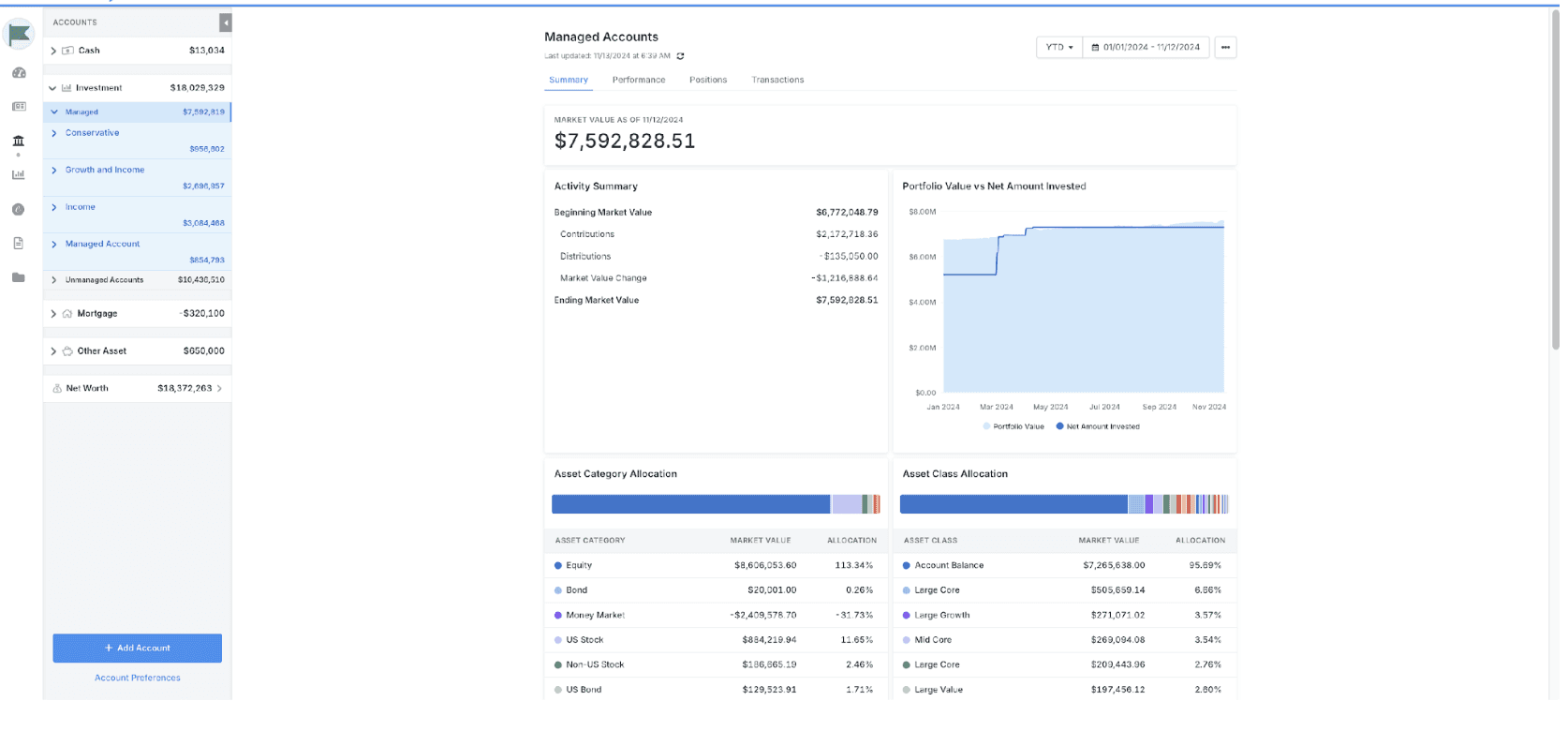

Investment Management

We manage everything for you using a strategic approach that aligns your behavioral attitudes, time-horizon, special circumstances, and short and long term financial goals with market conditions.

Retirement Planning

View weekly, monthly, and yearly goals aimed at keeping you on track for retirement. Your plan will be specialized to your unique circumstances and long term goals and influences. We believe retirement is possible for everyone with the right plan in place.

Tax Efficient Strategies

We take a proactive approach to tax efficiency in every aspect of your financial plan. From optimizing your investment portfolio with tax-smart strategies to carefully timing withdrawals, contributions, and estate transfers. Our goal is to help you keep more of what you earn and grow your wealth with intention.

Estate Planning

We help you create a personalized estate plan that protects your legacy, and minimizes the tax burden on your heirs. From wills and trusts to wealth transfer strategies, our guidance seeks to provide confidence for future generations.

Fee-Only Insurance Planning

Through our unique insurance partnership we are able to provide clients with access to fee-only life insurance. Providing the opportunity to save, we make sure you are covered where it counts, and where it makes financial sense. We aim to align your life insurance strategy with your goals to protect your wealth and your family’s future.

What are You Planning For?

*Not current clients, for illustrative purposes only.

Jarrod and Ashley Early 30's

First Home

You're building a life together- maybe buying a home, thinking about kids, and getting serious about investing. Our advisors will guide you through budgeting, debt management, and insurance planning to secure the foundation your family deserves.

Elizabeth and Alice

Late 30's

Rental Property

You've worked hard to get where you are- climbing to the top and reaching peak earning years. You are beginning to think bigger, but with success comes complexity. Our advisors will help you move with confidence by creating a personalized tax strategy and discussing potential moves into real estate acquisition.

Josh and Maria

Mid 40's

College Savings

You're balancing a lot- kids, a mortgage, a career. Our advisors will help you make smart decisions about college savings, insurance planning, and continue setting the stage for your retirement. At this complex stage of life a single financial plan will create clarity and provide guidance as you balance significant decisions.

Kevin and Andrea

Late 50's

Prepare for Retirement

Retirement is no longer a distant idea- it's on the horizon. We help you map out the next phase with precision, making sure your assets are protected, income is reliable, and taxes are minimized. From refining your investment strategy to updating your estate plan, we help ensure you and your family are secure for the decades ahead.